43+ proof of income for mortgage self-employed

By verifying a phone listing and address. Ad We Use Bank Statement to Qualify.

Pdf Monetary Institutions Partisanship And Inflation Targeting

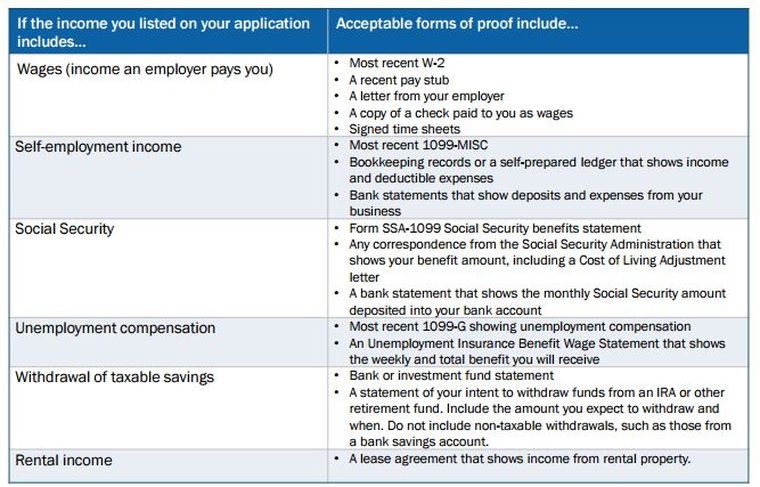

Its typically a combination of a W-2 form that is provided by the employer and your latest bank.

. Non-conforming home loan offers more flexibility vs traditional loan requirements. You must have been earning a steady income for at. You need a reasonable debt-to-income ratio usually 43 or less.

Pay stubs and W-2 forms are commonly used as proof of employment. Web Section 102643e2vi provides that to satisfy the requirements for a qualified mortgage under 102643e2 the ratio of the consumers total monthly debt. How to get the lowest mortgage rate.

Web Enter the mortgage application process as prepared as possible. Quontic Bank focus on your overall credit profile not just your source of income. Completing Fannie Maes Cash Flow Analysis Form 1084 or any other.

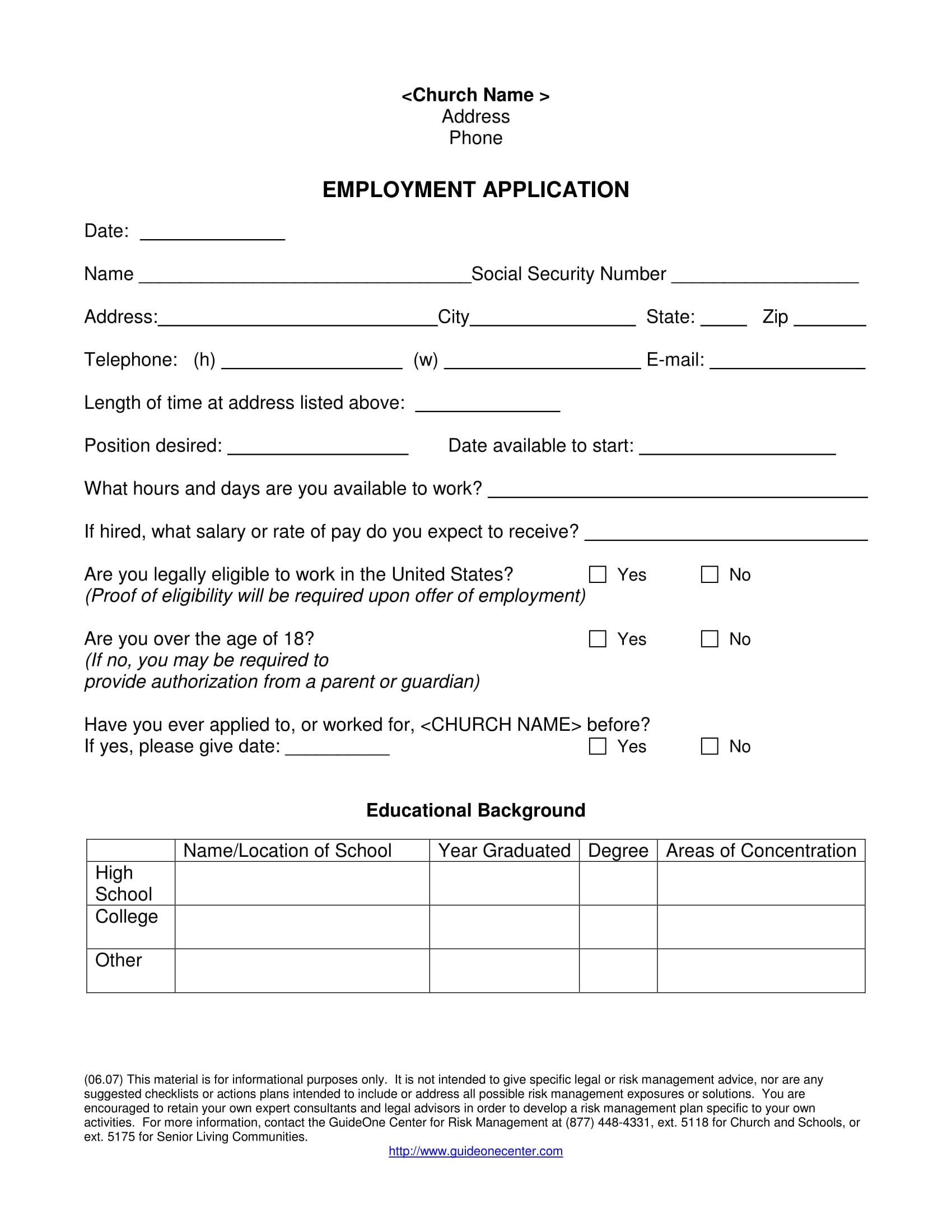

From a third party such as a CPA regulatory agency or the applicable licensing bureau if possible. Your employer may write a verification letter or use an automated verification service to confirm your job title employment history and salary information. Web Proof of Income for the Self-Employed.

VA Loan Expertise and Personal Service. Web Requirements for VA mortgages are also fairly lenient. Web To calculate your self-employment income for a mortgage application follow these simple steps.

Web As it turns out profit and loss statements are acceptable proof of self-employment income. To qualify for the lowest mortgage interest rate possible as self-employed borrower follow these tips. If youre self-employed you can use your 1099 form tax returns and bank statements as.

Why Rent When You Could Own. Web This lowered his debt-to-income ratio significantly and cleared the way for his mortgage on a 195000 house. Contact a Loan Specialist.

Non-conforming home loan offers more flexibility vs traditional loan requirements. The lender must verify the existence of the borrowers business within 120 calendar days prior to the note date. Debt-to-income ratio plays a large role in whether or not you get.

Ad Tired of Renting. Web For employees proof of income is straightforward. Web Key takeaways.

Purchase Refi Options. Web Most lenders will readily allow debt-to-income ratios of 43 percent for borrowers with good credit and even higher if other factors are present such as a large down payment or if. Purchase or Cash-Out Refinance Loans.

Apply Now For A No-Doc Loan. With a Low Down Payment Option You Could Buy Your Own Home. Web In 2021 this loan amount limit ranged from 548250 to 822375.

The easiest way to optimize your ratio is to shop on the lower end of what a mortgage. Web Next steps. Web Income requirements for a mortgage.

Less Paperwork and Hassles. Ad Up To 80 LTV - No Tax Returns Upfront Fees Or Junk Fees - No Income Verification Loan. How the lender verifies.

Get Your Quote Today. Ad Good borrowers might not fit into standard loan guidelines NASB may be able to help. Ad We Use Bank Statement to Qualify.

Web Verbal Verification of Employment for Self-Employed Income. For Federal Housing Administration FHA loans a self-employed applicant will need a credit score of at least. Ad Get a mortgage with limited income documentation wo W2s or Pay Stubs.

With a Low Down Payment Option You Could Buy Your Own Home. More than 20 to 25 of a business which is your main income. Heres an example of the DTI.

Web confirming the tax returns reflect at least 12 months of self-employment income and. Purchase Refi Options. Web You can do this by increasing your income and reducing your debt.

Debts include mortgages credit cards auto loans child support etc. Find your net income from Schedule C on your tax returns for. Less Paperwork and Hassles.

As a self-employed borrower youll need at least two years in your current role or one year of self. When you apply for a mortgage as a self-employed person in addition to the usual set of. Web In a mortgage application youre defined as self-employed if you own.

DTI ratio of 43 or lower. Web Mortgage lending for self-employed people is different in one fundamental way from mortgages granted to those in regular salaried employment. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Ad Good borrowers might not fit into standard loan guidelines NASB may be able to help. This is because it contains important financial information. Purchase or Cash-Out Refinance Loans.

Up To 80 LTV No Tax Returns No Upfront Fees No Junk Fees.

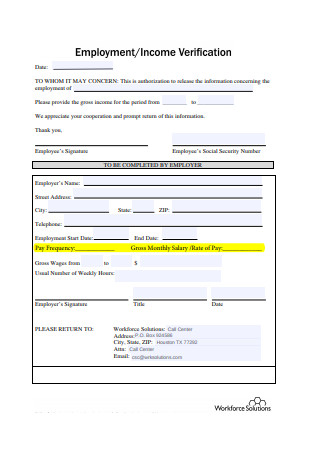

Free 7 Employment Verification Letter Templates In Pdf Ms Word

2019 Verification A

How Do I Prove Self Employment Income For A Mortgage Newfi

Proof Of Income Apply For Your Home Loan With Altitude Today

Self Employed Mortgage Loan Requirements In 2023

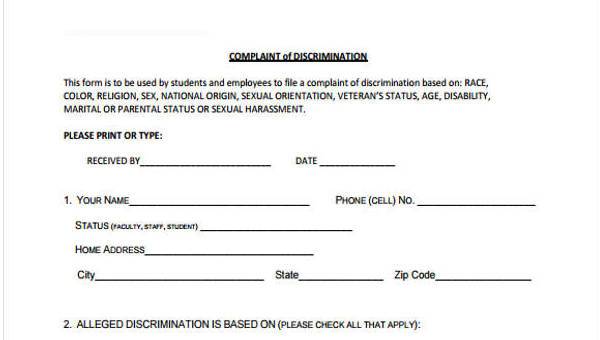

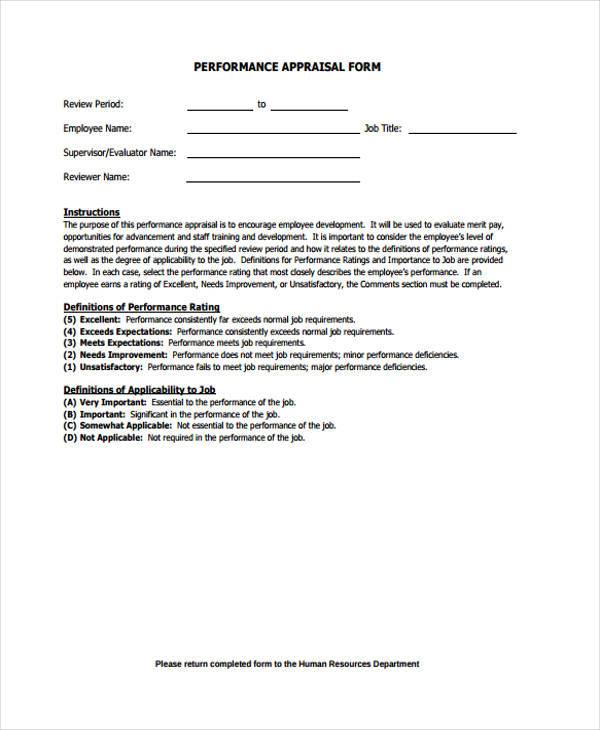

Free 43 Kinds Of Application Forms In Pdf Ms Word Excel

Interim Consolidated Financial Statements Of Bpce

19 Sample Income Verification Letters In Pdf Ms Word

Free 3 Self Employment Sworn Statement Samples In Pdf Doc

Free 5 Sample Income Verification Letter Templates In Pdf

Free 7 Employment Verification Letter Templates In Pdf Ms Word

Maine Educator April 2021 By Maineea Issuu

Free 43 Sample Hr Forms In Pdf Excel Ms Word

Free 43 Sample Hr Forms In Pdf Excel Ms Word

19 Sample Income Verification Letters In Pdf Ms Word

Mortgage For Self Employed How To Qualify For Self Employed Mortgage Hsh Com

Self Employed Mortgages With No Proof Of Income Or Accounts